CCW Courses and Tips

Is Concealed Carry Insurance Worth It? A 2025 Review

At Cloudster Pillow, we understand the importance of safety and peace of mind for responsible gun owners. Concealed carry insurance has become a hot topic in 2025, with many carriers wondering if it’s a worthwhile investment.

This comprehensive review will explore the pros and cons of concealed carry insurance, helping you make an informed decision. We’ll break down the coverage options, legal considerations, and potential benefits to determine if this type of insurance is right for you.

What Is Concealed Carry Insurance?

Definition and Purpose

Concealed carry insurance provides specialized protection for gun owners who carry firearms for self-defense. This type of insurance covers legal expenses and potential damages if you become involved in a self-defense incident. Unlike standard liability insurance, concealed carry insurance focuses specifically on firearms-related incidents.

Coverage Types and Limits

Most concealed carry insurance plans offer criminal defense coverage, which protects you if you face charges after using your firearm in self-defense. CCW Safe, for example, provides unlimited criminal defense coverage, ensuring protection regardless of the case’s complexity or duration.

Civil liability protection constitutes another key component. Even if criminal charges don’t stick, you might face a civil lawsuit. USCCA offers self-defense liability insurance policy that comes with USCCA Membership.

Legal Support and Resources

A standout feature of concealed carry insurance is access to legal expertise. Many providers offer 24/7 hotlines staffed by attorneys who specialize in self-defense law. This immediate access to legal advice proves invaluable in the chaotic aftermath of a self-defense incident.

Some insurers, like Right to Bear, include additional perks such as psychological support and online training content. These resources help you navigate the emotional and practical challenges of carrying a firearm responsibly.

Cost Considerations

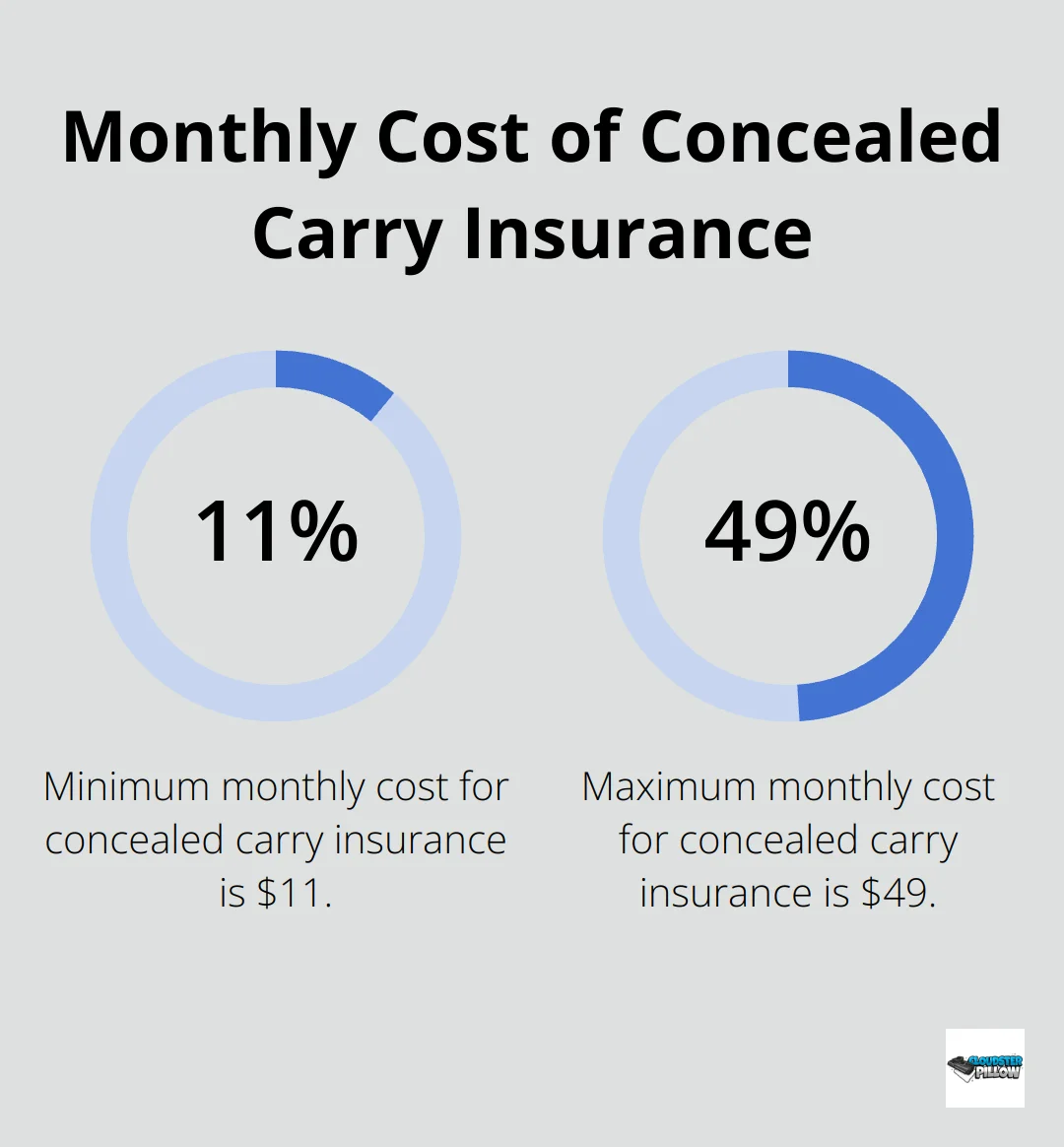

Concealed carry insurance typically costs between $11 and $49 per month, depending on the provider and plan. It’s essential to weigh these costs against the potential financial risk of facing legal action without coverage.

Choosing the Right Provider

When selecting a concealed carry insurance provider, consider factors such as:

- Coverage limits (both criminal and civil)

- Upfront payment vs. reimbursement models

- Additional benefits (e.g., training resources, psychological support)

- Customer reviews and reputation

- State-specific coverage options

As you explore your options for concealed carry insurance, it’s important to understand both the benefits and potential drawbacks. Let’s examine the pros of concealed carry insurance in more detail.

Why Concealed Carry Insurance Makes Sense

Comprehensive Legal Protection

Concealed carry insurance offers significant advantages for responsible gun owners. One of the most compelling reasons to invest in this type of coverage is the extensive legal protection it provides. In the event of a self-defense incident, you’ll have immediate access to expert attorneys who specialize in firearms law. This can make a crucial difference in the outcome of your case.

CCW Safe offers unlimited criminal defense coverage, ensuring you’re protected regardless of how long or complex your case becomes. This level of support can save you hundreds of thousands of dollars in legal fees. The average cost of a criminal defense case exceeds $100,000 (according to recent data from the National Association of Criminal Defense Lawyers).

Financial Safeguard Against Civil Lawsuits

Even if you’re cleared of criminal charges, you may still face a civil lawsuit. Concealed carry insurance provides a vital financial safety net in these situations. USCCA offers up to $2 million in civil liability coverage as part of their membership package.

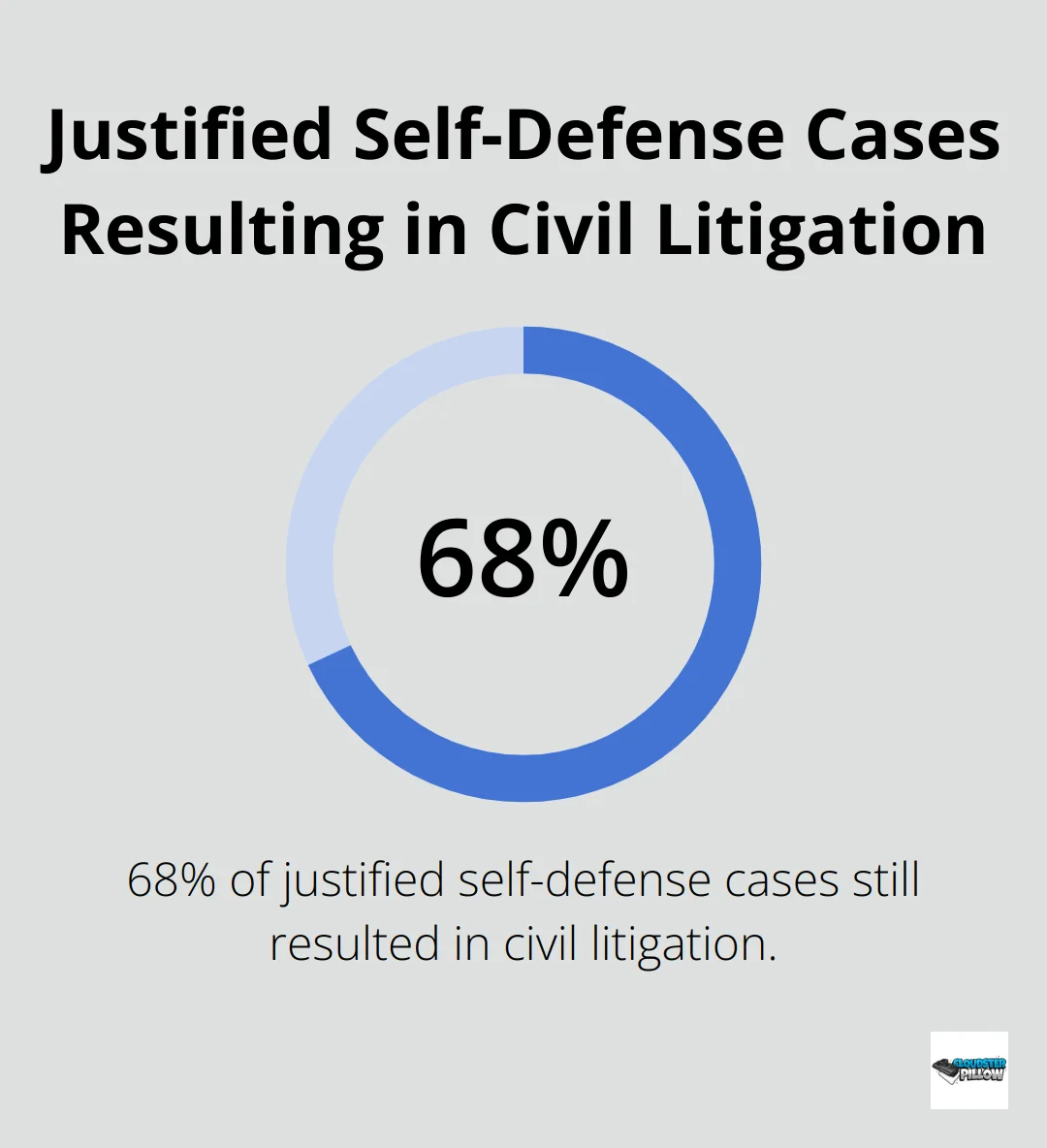

This protection is particularly important given the increasing trend of civil lawsuits following self-defense incidents. A 2024 study by the Crime Prevention Research Center found that 68% of justified self-defense cases still resulted in civil litigation, highlighting the need for comprehensive coverage.

Expert Resources at Your Fingertips

Beyond legal representation, many concealed carry insurance providers offer a wealth of educational resources. These can include online training modules, webinars with legal experts, and access to firearms instructors.

Right to Bear Insurance provides members with extensive online training content covering topics from situational awareness to de-escalation techniques. This ongoing education helps ensure that you’re well-prepared to handle potential self-defense scenarios responsibly.

Peace of Mind for Daily Carry

Perhaps the most significant benefit of concealed carry insurance is the peace of mind it provides. Knowing that you have robust legal and financial protection allows you to carry your firearm with confidence. This psychological benefit shouldn’t be underestimated-it can make a real difference in your daily life and decision-making process.

Tailored Coverage Options

Many concealed carry insurance providers offer various plans to suit different needs and budgets. This flexibility allows you to choose coverage that aligns with your specific situation and risk tolerance. Some plans (like those offered by US & TX Law Shield) start at just $10 per month, making this valuable protection accessible to a wide range of gun owners.

While the benefits of concealed carry insurance are clear, it’s important to also consider potential drawbacks. Let’s examine some of the cons associated with this type of coverage to provide a balanced perspective.

The Hidden Costs of Concealed Carry Insurance

Financial Burden and Premium Variations

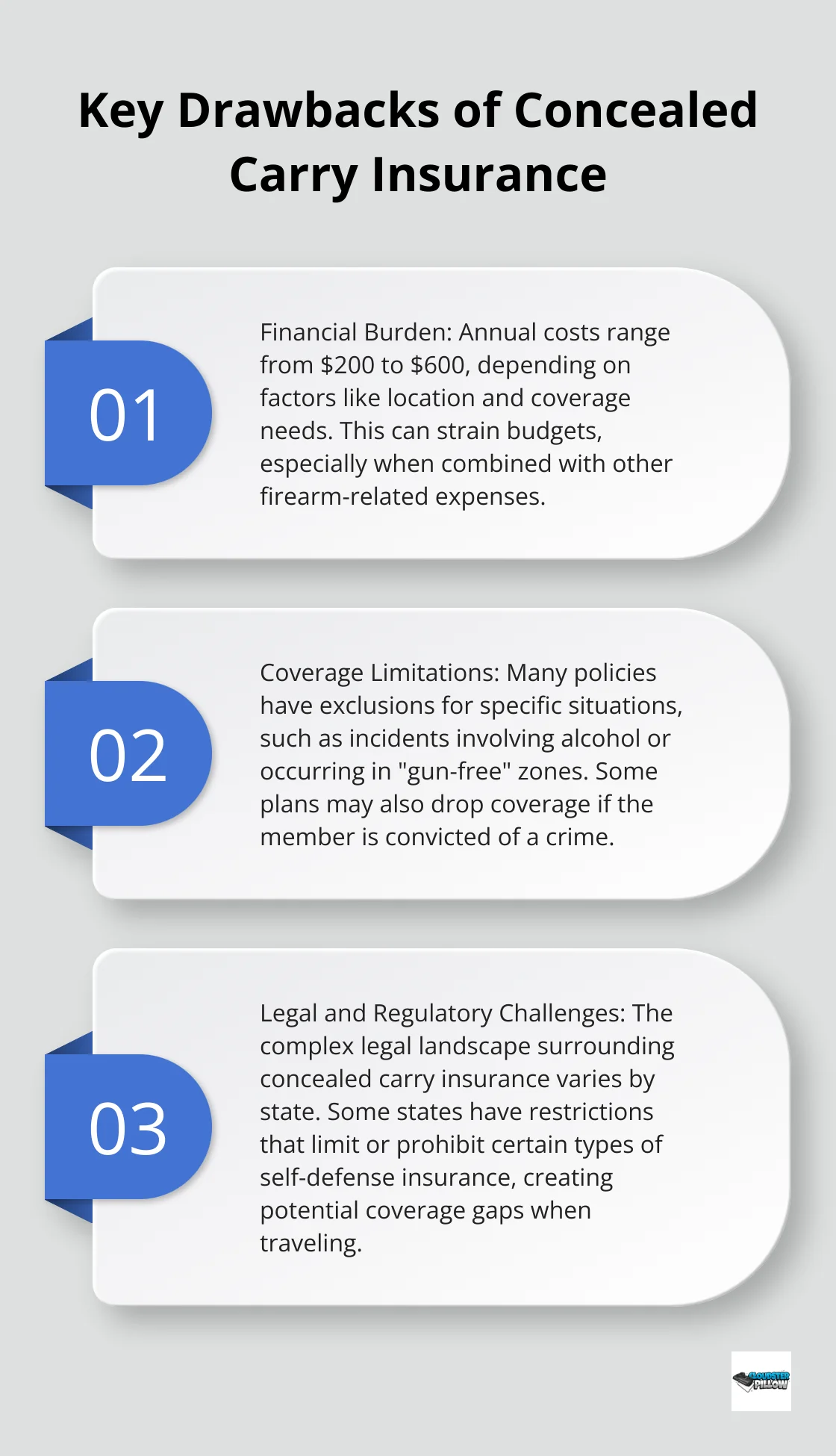

Concealed carry insurance can place a substantial financial burden on gun owners. You may have to pay around $200 to $600 per year for CCW coverage depending on factors like where you live, what your occupation is, and what your specific coverage needs are. This expense might strain your budget, especially if you already invest in quality gear and training.

The cost differences between providers can be significant. These variations highlight the need for thorough comparison shopping before committing to a plan.

Coverage Limitations and Exclusions

A close examination of concealed carry insurance policies reveals important limitations. Many plans exclude coverage for specific situations, which could leave you vulnerable. Some policies don’t cover incidents involving alcohol or those occurring in “gun-free” zones. Others exclude coverage for unintentional or negligent discharges.

USCCA faced criticism for policies that potentially dropped coverage if a member was convicted of a crime. Your USCCA coverage ends if you get convicted of a crime, and if found guilty, you may have to pay back the costs. This issue underscores the importance of understanding your policy’s terms and conditions in detail.

Legal and Regulatory Challenges

Concealed carry insurance operates in a complex legal landscape. Some states have restrictions that limit or prohibit certain types of self-defense insurance. For example, in New Jersey, concealed carry is legal with a CCW permit, but there may be specific regulations regarding insurance. This patchwork of regulations creates confusion and potentially leaves you without coverage when traveling across state lines.

The legal status of concealed carry insurance remains subject to change. You must stay informed about your state’s laws and how they interact with your insurance coverage.

False Sense of Security

One of the most insidious drawbacks of concealed carry insurance is its potential to create a false sense of security. Some gun owners might feel emboldened to take unnecessary risks, believing their insurance will protect them from any consequences.

No insurance policy can prevent the emotional and psychological trauma of a self-defense incident. The best approach always involves avoiding confrontation and using your firearm only as an absolute last resort.

Final Thoughts

Concealed carry insurance offers significant benefits for responsible gun owners in 2025. The comprehensive legal protection and financial safeguards provide peace of mind for those who choose to exercise their right to carry. However, potential drawbacks include costs, coverage limitations, and legal complications that cannot be ignored.

Your decision on concealed carry insurance should depend on personal risk factors, financial situation, and local laws. We recommend thorough research and comparison shopping to find the provider that best suits your needs. Each company offers unique benefits and limitations, so take the time to read policy details and understand exclusions.

At Cloudster Pillow, we focus on enhancing your concealed carry experience. Our adjustable comfort solution for IWB and AIWB holsters improves both comfort and concealment. The Cloudster Pillow complements your concealed carry setup, allowing you to prioritize your safety and peace of mind.

Pingback: Do You Really Need CCW Insurance in 2025?

Pingback: Understanding Conceal Carry Laws 2026 for Gun Owners